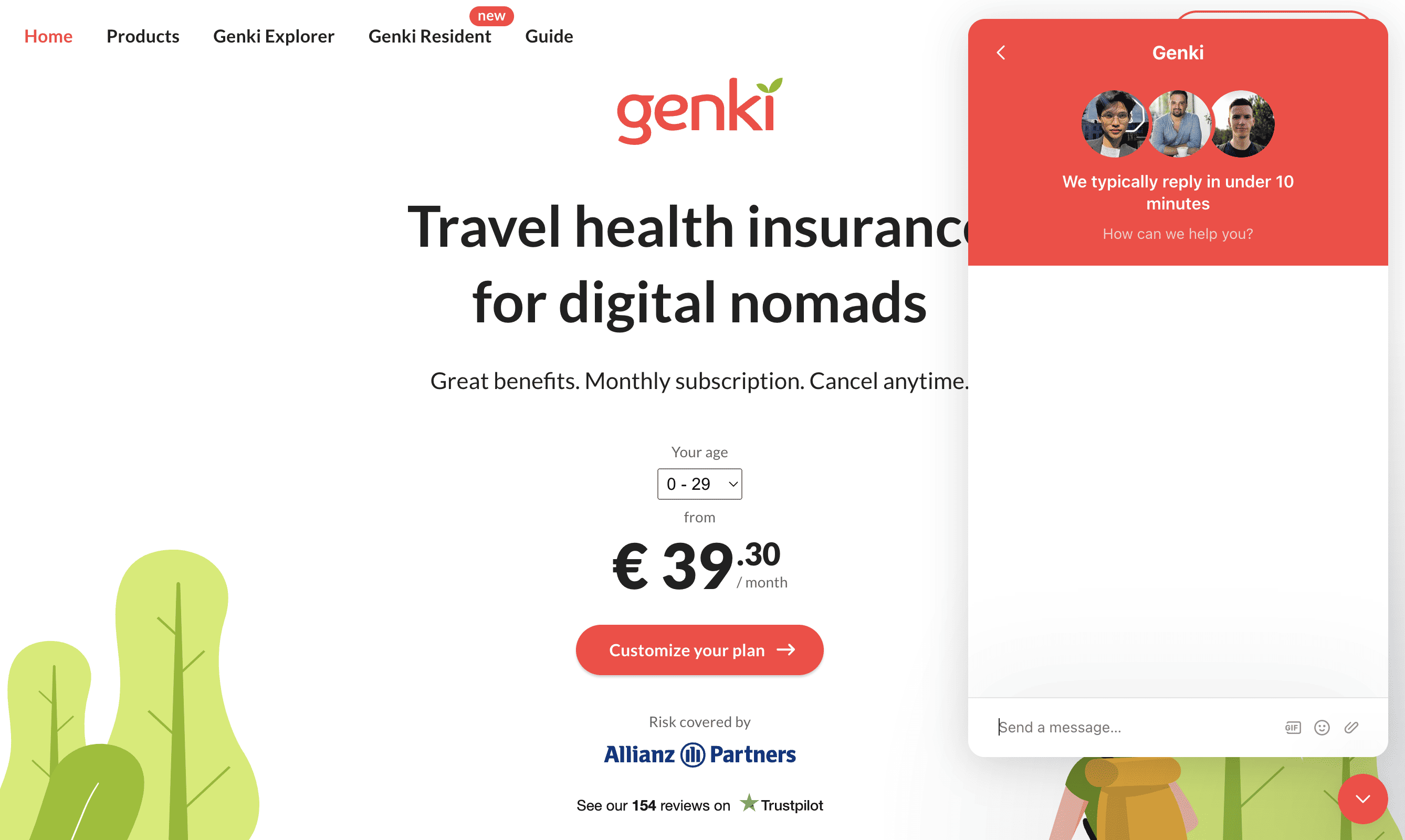

There is a new travel insurance company flying around and it might just be the best yet.

The truth is that digital nomad insurance has been a pretty one-sided story. But that’s about to change!

Genki Insurance offers a very high level of medical travel insurance aimed at digital nomads, travelers and remote workers. You’ll get:

- Great coverage

- Good customer service

- Flexible monthly plans

- Excellent prices

And most importantly – Genki already has a reputation for processing claims in a timely manner (without you needing to follow up 50 times).

Sounds almost too good to be true?

In this Genki Insurance review, I will lift the lid on what Genki is really like and whether you should trust them as your travel insurance provider.

Let’s jump in!

Genki Insurance Review – Who Is Genki Insurance?

Genki is a one way travel insurance company that offers quality travel medical insurance for an affordable price.

Genki is primarily targeted toward digital nomads, long-term travelers and remote workers.

They offer transparent travel insurance plans and allow you to signup almost anywhere in the world. The plans run on a monthly subscription so you can signup and are billed each month automatically.

All Genki insurance plans have maximum coverage for up to 2 years and can be canceled anytime. After the coverage period finishes, you can signup again for another 2 years.

Genki Insurance is backed by insurance giant Allianz Partners and claims are handled by DR-WALTER. This means that Allianz and DR-WALTER take the “risk” when you sign up with Genki Insurance.

That’s good because these big companies aren’t likely to go out of business!

What Makes Genki Different From Other Travel Insurance?

There are a couple of unique things that make Genki stand out from the rest.

Apart from the typical travel medical insurance, here’s a quick review of Genki’s unique features:

- Insurance designed for digital nomads – Genki was created with digital nomads in mind. All of their insurance policies are catered toward long-term, frequent travelers.

- Subscription model – Genki doesn’t make you pay for a whole year (or longer) upfront. You will be billed on a monthly subscription on the same day each month.

- Long-term continuous insurance – You can be covered by Genki for up to 2 years continuously as long as you maintain your subscription.

- Buy outside your home country – You aren’t required to be in your home country to sign up for Genki.

- Buy insurance with a one-way ticket – Genki doesn’t require you to have a return tick to your home country or have a set itinerary of where you are traveling.

- Fast insurance payouts – Genki has one of the quickest payout schedules of any insurance company I’ve reviewed. They generally pay claims within 2-5 weeks or direct to the hospital depending on the situation.

- Solid medical insurance – Genki focuses on medical insurance that covers an excellent range of medical issues.

- Transparent and easy signup process – You can sign up for Genki in less than 3 minutes with a quick and transparent process.

- Clear payment structure – There’s no need for multiple plan tiers and complicated quotes. Genki has a simple payment structure that makes it easy to understand what you get and what you pay.

As you can see, Genki has a ton of great benefits for its members. It’s easy to sign up and they have very transparent policies, which is rare for insurance companies.

But you might be thinking…

Doesn’t SafetyWing offer these benefits too?

The truth is that SafetyWing is definitely Genki’s biggest competitor and they both have a lot of similarities. But when you look beneath the surface, both companies have several unique differences.

At the end of this blog is a specific section dedicated to Genki Insurance vs SafetyWing nomad insurance so you can see the differences for yourself.

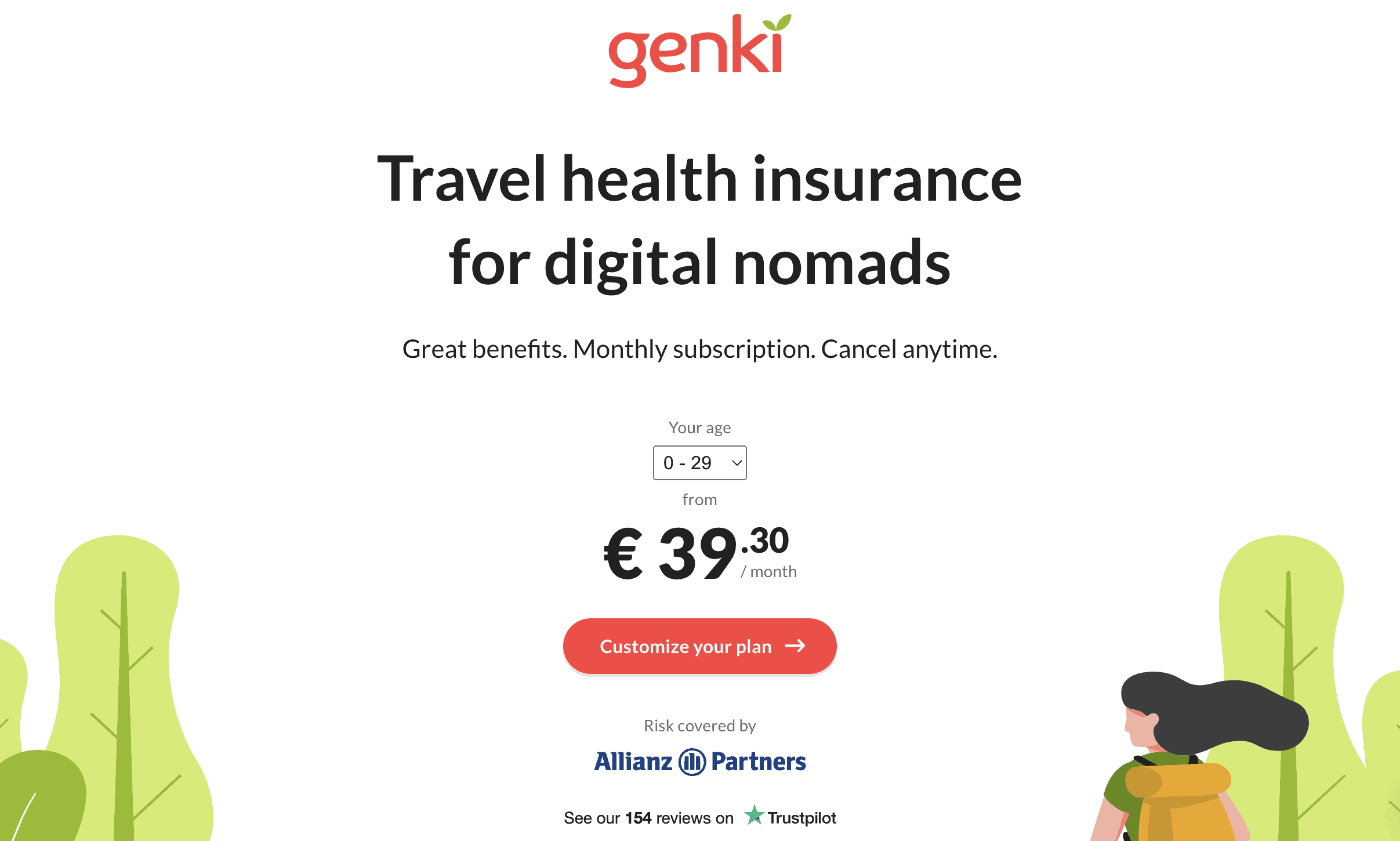

How Much Does Genki Insurance Cost?

Genki has very straightforward pricing that is easy to understand. So how much does Genki cost?

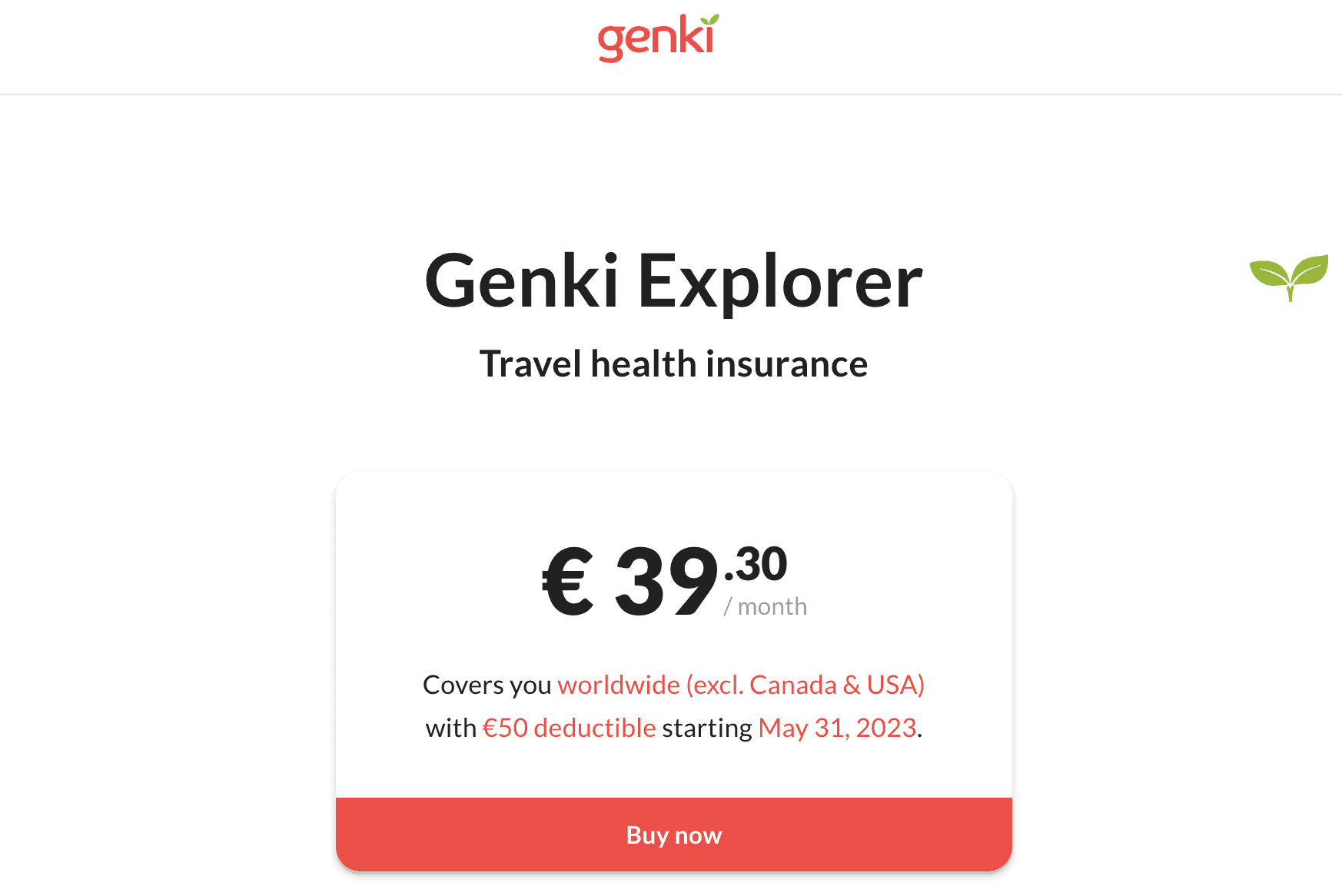

Genki insurance starts at just €39.30 per month.

But the end price you pay comes down to-

- Your age

- The regions of cover you choose

- The deductible you choose

Here’s a table that shows the full breakdown of how much Genki insurance costs with all plan options:

| Age Range | Worldwide – EXCLUDES U.S | Worldwide – INCLUDES U.S |

| 0 to 29 | €39.30 | €86.70 |

| 30 to 39 | €54.60 | €108.30 |

| 40 to 49 | €60.00 | €130.20 |

| 50 to 59 | €78.00 | €169.20 |

| 60 to 69 | €116.70 | €253.50 |

As you can see from the table, if you want full coverage for Canada and the United States, it will cost you about double which is pretty standard for most nomad travel insurance companies.

Currently, Genki doesn’t offer travel insurance for people ages 70+. You can check out their long-term health insurance options if you are 70 or older.

Genki also adds an option for a €0 deductible in your plan. This could be a really nice benefit!

It will add about €10 to €30 per month. In my opinion, if you expect to claim less than once about every 5-6 months, it doesn’t really make financial sense for most people to have the €0 deductible option.

But the option is there if you want it.

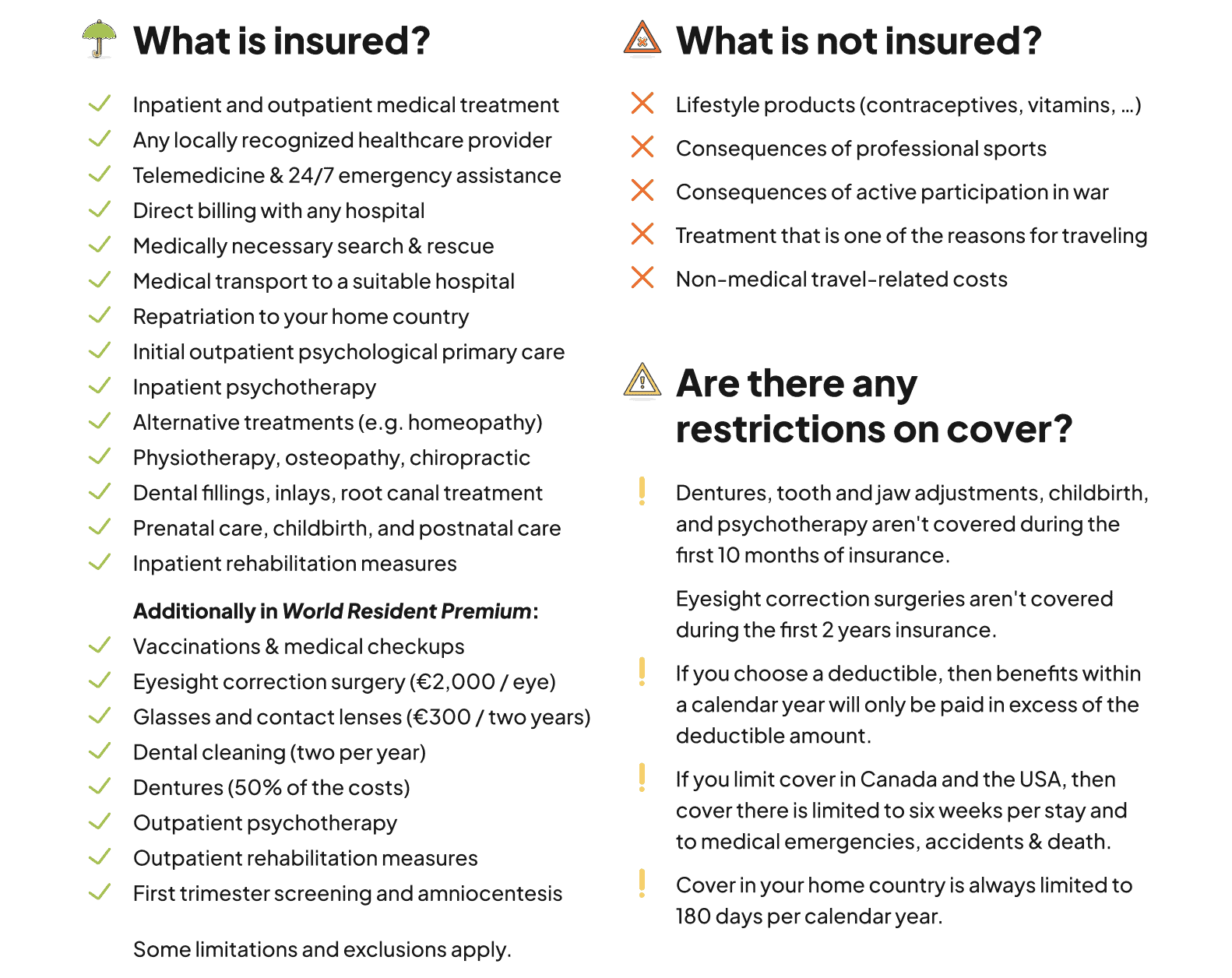

Genki Travel Insurance Coverage

Ready to dive into all the details?

Below I have outlined what Genki Insurance covers so you can see what you are getting. Let’s get started!

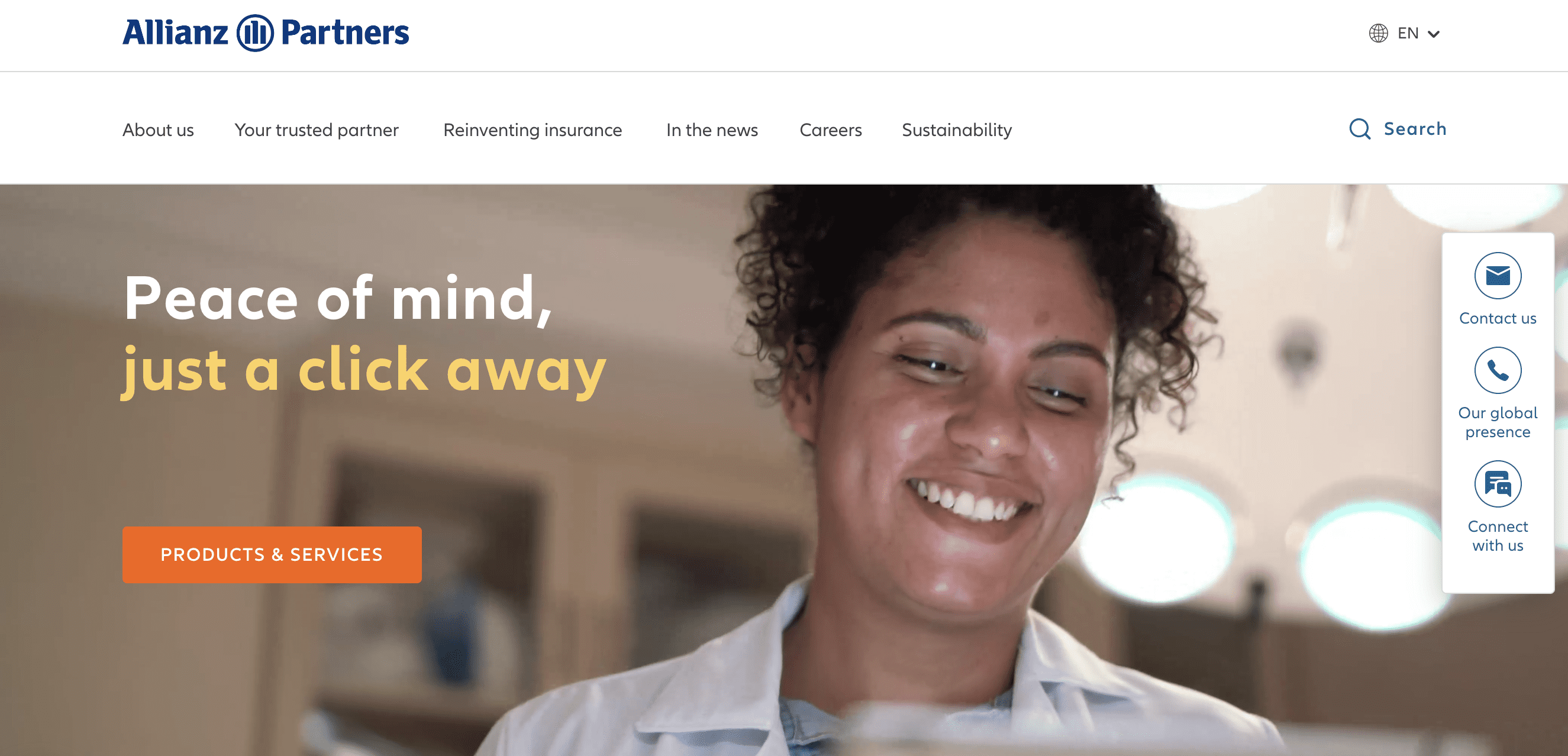

Where Are You Covered With Genki Insurance?

Simply put – Genki has just one travel health insurance plan.

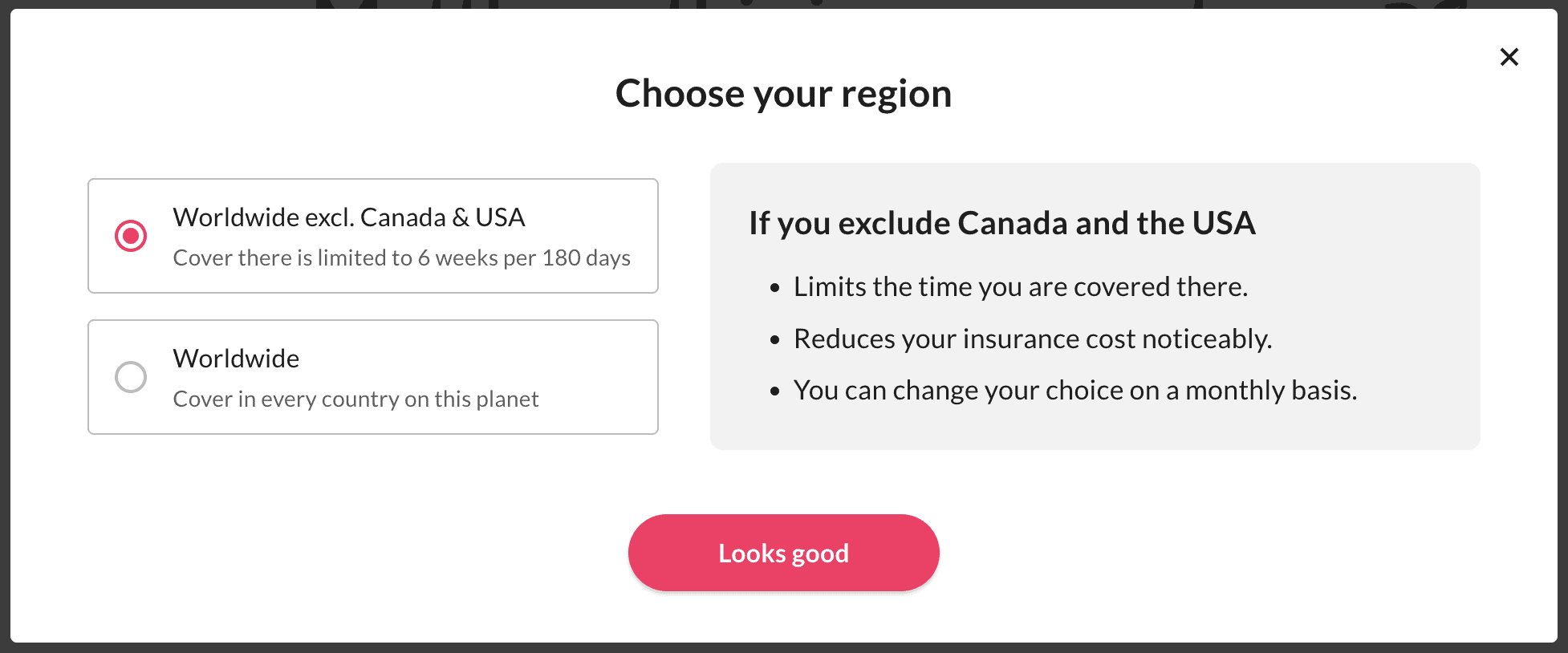

But Genki has 2 different options for the coverage:

- Option 1 – Worldwide (all countries)

- Option 2 – Worldwide (excluding Canada and the United States)

At first glance, they look self-explanatory, but there are a couple of things you should be aware of.

Option 1 Worldwide coverage means that you are covered in every country on earth. There are some limitations in your home country, but they apply to both options.

Option 2 means you are covered in every country, but the coverage in Canada and the USA are limited. Yes, you still get some coverage in the USA and Canada, but it’s limited to 6 weeks per 180 days.

This is actually a very unique and impressive offering.

It essentially means that you are ONLY covered for 6 weeks in every 180 days in Canada and the United States. If you only plan to visit the United States and Canada for less than 6 weeks combined, then you will be fine with Option 2.

If you plan to stay longer, Option 1 makes sense.

Cost is the biggest difference in the plan options (other than coverage).

You’ll pay about double for Option 1 compared to Option 2. This is very similar to other digital nomad travel insurance companies.

Medical Coverage

Medical coverage is where Genki stands out the most.

They offer comprehensive medical coverage with a few extra benefits. Here’s a full breakdown of their medical coverage:

| Medical Coverage | Limit |

| Emergency inpatient treatment and outpatient treatment, including operations | No limit |

| Medicine, remedies and dressing material | No limit |

| Dental treatment for pain relief and simple fillings as well as repair of existing dentures and dental prostheses per case |

€ 500 |

| Medically necessary dental treatment as a result of an accident | € 1,000 |

| Outpatient initial treatment of mental illnesses | € 1,500 |

| Inpatient emergency treatment of first-time mental or emotional disorders | € 20,000 |

| Transport costs to the nearest hospital (e. g. with ambulance vehicles) | No limit |

| Return transport to the Insured Person’s place of residence in their home country | No limit |

| Transport of the Insured Person’s mortal remains (repatriation costs) | No limit |

As you can see, Genki has an excellent level of medical travel insurance. It even covers extra benefits like emergency dental and mental/emotional issues.

A few of the other unique benefits that Genki offers with their emergency medical assistance coverage are:

- If you are likely in hospital for more than 5 days, Genki pays your friends/family’s transport costs

- 24-hour medical care hotline that guarantees organized direct payments to hospitals

- Treatment at any locally authorized healthcare provider or medical facility around the world

- Most medical-related incidents have no limit on coverage (this is very rare)

Overall the medical coverage offered by Genki is better than most other travel insurance providers. Almost all of the medical coverage benefits don’t have a limit! This is very rare for any travel insurance company.

The level of Medical coverage will more than satisfy most people and should mean you are well-protected if you have any issues.

Is COVID-19 Covered?

Short answer – Yes, COVID-19 is covered as part of Genki’s insurance plans.

But you need to understand exactly what that means…

COVID-19 coverage is for medically necessary treatment as a direct result of COVID-19. This means that if you need to go to the hospital because of COVID-19, Genki should cover it for you.

The other massive benefit of Genki’s COVID-19 coverage is no cost limit. Most travel insurers have a limit on the amount for COVID-19 insurance coverage.

Be aware – COVID-19 coverage from Genki does not cover you for quarantines.

Why?

Because they are not considered medically necessary. This is a standard policy for travel insurance but it is good to keep in mind.

If you need to prove COVID-19 insurance to enter a country you can download your insurance certificate from your Genki profile. It’s stated explicitly on the certificate and should be suitable for immigration into any country.

Activities Covered

Activities are where most insurance companies differ in terms of what’s covered and what’s not.

Genki has a clear list of exclusions for activities that are called “dangerous activities”. If the activity is NOT on the exclusion list – it should be covered.

The list of dangerous activities that are excluded from the Genki insurance plans are:

- Motorcycle and car racing

- Parachuting

- Paragliding

- Bungee jumping

- Base jumping

- Mountaineering (if specialized equipment is required)

- Free climbing

- Diving

If you plan on doing any of these activities, get additional insurance to cover them. Most companies that offer these activities usually also include some form of insurance anyway.

But make sure you check before you start! What about activities that are covered by Genki?

Some of the activities that are covered by Genki include-

- Surfing

- Kitesurfing

- Skiing

- Snowboarding

- Kayaking

- Cycling

- Mountain biking

- Hiking

- Muy Thai

- General sports

And so many more. Impressively Genki has managed to include some activities that most other travel insurance companies would exclude.

Notably – Skiing and Snowboarding are usually excluded from different travel insurance policies. The amount of activities included by Genki is really solid.

There isn’t a travel insurance company that I have reviewed that has more activities included in their policy than Genki!

But one question lots of digital nomads ask about travel insurance…

Does Genki cover scooter accidents and crashes?

Yes. The good news is that Genki will cover scooter crashes and accidents.

What’s more?

The support team told me that you are even covered for scooter crashes if you don’t have a license.

What a relief for all those digital nomads in Bali and Chiange Mai at the moment! I haven’t seen coverage like this in any other travel insurance company that I’ve reviewed.

Are There Any Deductibles?

Deductibles are the amount you need to pay as part of the insurance policy.

Genki has very low to no deductible based on what you choose. The standard deductible is just €50 per issue that arises. This means you will have to pay the deductible for any insurance issue whenever you make a claim.

Don’t want to pay the deductible?

You don’t have to.

Genki has an add-on option that allows you to get travel insurance without a deductible.

This add-on will come at an extra cost of about €10 per month.

Are You Covered In Your Home Country?

As full-time digital nomads, we don’t spend a ton of time in our home countries.

But that doesn’t mean we don’t go home to visit friends and family every now and then. For Ashley and I, we tend to go back to our home countries about once per year.

It’s important for us to get coverage for that period – even if it’s just a few weeks.

Genki offers limited coverage to members in their home country. But when I say limited, it’s actually very good.

You are covered in your home country for up to 6 weeks (42 days) per 180 days. That means you should be covered if you drop in to see friends and family over Christmas for a couple of weeks.

The only thing to remember is that coverage in your home country only includes accidents and life-threatening emergencies. Visiting the doctor for a “check-up” isn’t going to be covered.

What’s Not Covered By Genki Travel Insurance?

While Genki covers a lot of travel and medical expenses, it doesn’t cover everything.

Remember you are buying travel insurance.

That means anything that is NOT medically necessary is generally NOT covered. Doctors are the ones that decide what is considered medically necessary, which is good because Doctors are generally on the side of caution.

And of course…

You aren’t covered for any accidents or injuries that occur while under the influence of excessive alcohol & drugs. Excessive can be a grey area – so keep that in mind.

Now that we have those out of the way, here is a list of other things not covered by Genki insurance.

Pre-existing Conditions & Limited Pregnancy Coverage

Pre-existing conditions are any medical issues that you have received treatment for in the past.

Genki also defines them as any medical issues you have sought advice for in the past 6-months.

It’s common for travel insurance policies not to cover a pre-existing medical condition. You can sometimes pay extra to cover specific conditions, but Genki doesn’t offer this,

A popular question we get is – are there any travel insurance companies covering pregnancy?

Genki doesn’t cover pregnancy if you knew you were already pregnant before getting the insurance policy. The only exception to this is acute and unforeseeable deterioration in the health of the mother or child.

This is good because if you have any major unforeseeable complications while pregnant and traveling, Genki should have your back!

Genki DOES cover pregnancy if you weren’t pregnant before starting your insurance plan. They offer:

- Check-ups up to the 12th week of pregnancy

- Two ultrasound examinations

- Treatment for complications

- Labor including birth assistants & midwives

- Postnatal care up to €50,000

If you are traveling as a digital nomad couple and something happens, you might have some coverage. But I wouldn’t rely on it if you plan to have a child while on the road.

Get digital nomad health insurance for that!

Dangerous Activities

Most travel insurance policies don’t cover dangerous activities.

The difference is what they count as dangerous activities. Genki’s dangerous activities list is actually minimal-

- Motorcycle and car racing

- Parachuting

- Paragliding

- Bungee jumping

- Base jumping

- Mountaineering (if specialized equipment is required)

- Free climbing

- Diving

If the activity IS NOT on that list above, it should be covered!

Genki’s competitors like SafetyWing and World Nomads have a massive list of exclusions for activities. Genki has the shortest dangerous activities list of any travel insurance company I have reviewed.

I encourage you to reach out to support if you have a specific activity you are undertaking and have any questions.

They are always really responsive and helpful!

Baggage Delays, Trip Cancellation & Personal Items

This is a big one:

Genki provides medical coverage. They currently don’t have any coverage for things like:

- Personal effects coverage

- Trip cancellation coverage

- Baggage delays or loss

Genki is focused on medical coverage and that’s how they keep their prices low, providing insurance that won’t break the budget.

If you want to cover other things like personal effects and baggage – Genki probably isn’t going to work for you at this time.

The Genki team told me they are working on coverage for baggage delays, trip cancellation and personal items. It will likely be introduced as an add-on.

Family & Age Limits

For families, this could be a significant downside.

Genki doesn’t offer any family coverage at this time. It’s also not possible to ensure your children if they are under the age of 18 years.

Speaking of which, Genki only offers insurance to people in two age brackets:

- 18 to 29 years old

- 30 to 49 years old

Digital nomad statistics show that this covers the vast majority of digital nomads and remote workers, which is their primary target audience. There is also a significant difference in price for people aged 18 to 29 vs those aged 30 to 49.

You’ll pay at least €19 more if you are in the 30 to 49 age bracket.

After talking with one of the Genki reps, the family coverage is on their radar. It will likely be offered later as an extra add-on.

If you have a family, Genki is probably not the best travel insurance for you at the moment.

14-Day Waiting Period

The first 14 days of your coverage are limited.

What does that mean?

The first 14 days of your insurance coverage with Genki are limited to just accidents and life-threatening emergencies. All the other benefits are on hold until the waiting period is over. Is that normal?

Yes and no.

It’s common enough with some insurance companies. My guess is that Genki has placed this 14-day waiting period because it is a German company that falls under German laws.

Here’s what I mean:

In Germany you have a right to completely refund your insurance in the first 14 days. If you are unhappy, you can contact Genki for a refund and they should give it to you. After that, they aren’t obligated by law to provide you with a refund.

This is likely why they’ve put a waiting period in place.

You are still covered for accidents and life-threatening issues during the waiting period.

World Resident Genki Health Insurance Plan

Want to level up your travel insurance to digital nomad health insurance?

Genki has just launched Genki World Resident – their new global health insurance plan and it’s actually really good!

They provide superior medical coverage and unbeatable value. All of this with the transparency that Genki customers have come to love and expect.

The 2 health insurance plans that Genki currently offers are:

- World Resident (starts from €105/month)

- World Resident Premium (starts from €125/month)

What’s the difference?

With World Resident Premium you get a lot more benefits such as vaccinations, medical checkups, eyesight correction surgery, glasses, contact lenses and so much more!

Both plans include medical treatment everywhere.

Find any locally recognized healthcare provider and you will be covered by Genki. It’s even possible to get your pre-existing conditions covered! You also have all sports coverage included which includes every sport – as long as you aren’t being paid to play.

As if that’s not enough…

Genki has managed to squeeze in extra benefits like telemedicine and alternative treatment.

In our opinion the amount of benefits you get with Genki World Resident vs the amount you pay is incredible. They have catapulted themselves into one of the best digital nomad insurance options available right now.

Want to learn more?

Check out Genki World Resident here.

Making A Claim With Genki Insurance

Claims are another area in which Genki stands out.

There are a few obligations that you have:

- File claims as quickly as reasonably possible

- Release the physician-patient privilege (if required)

- Provide proof of prior healthcare cover (if required)

You’ll also likely need to provide supporting documents from doctors with your claim. But the good news is the Genki insurance claims are processed quickly.

You should receive a verdict on every claim within 2-4 weeks after filing.

This is really quick.

Many travel insurance companies can take up to 5-12 weeks just to provide a verdict. That doesn’t include making the payout.

The claim times around digital nomad insurance are a big issue. Genki has eliminated this issue and processes claim requests much faster than most competitors.

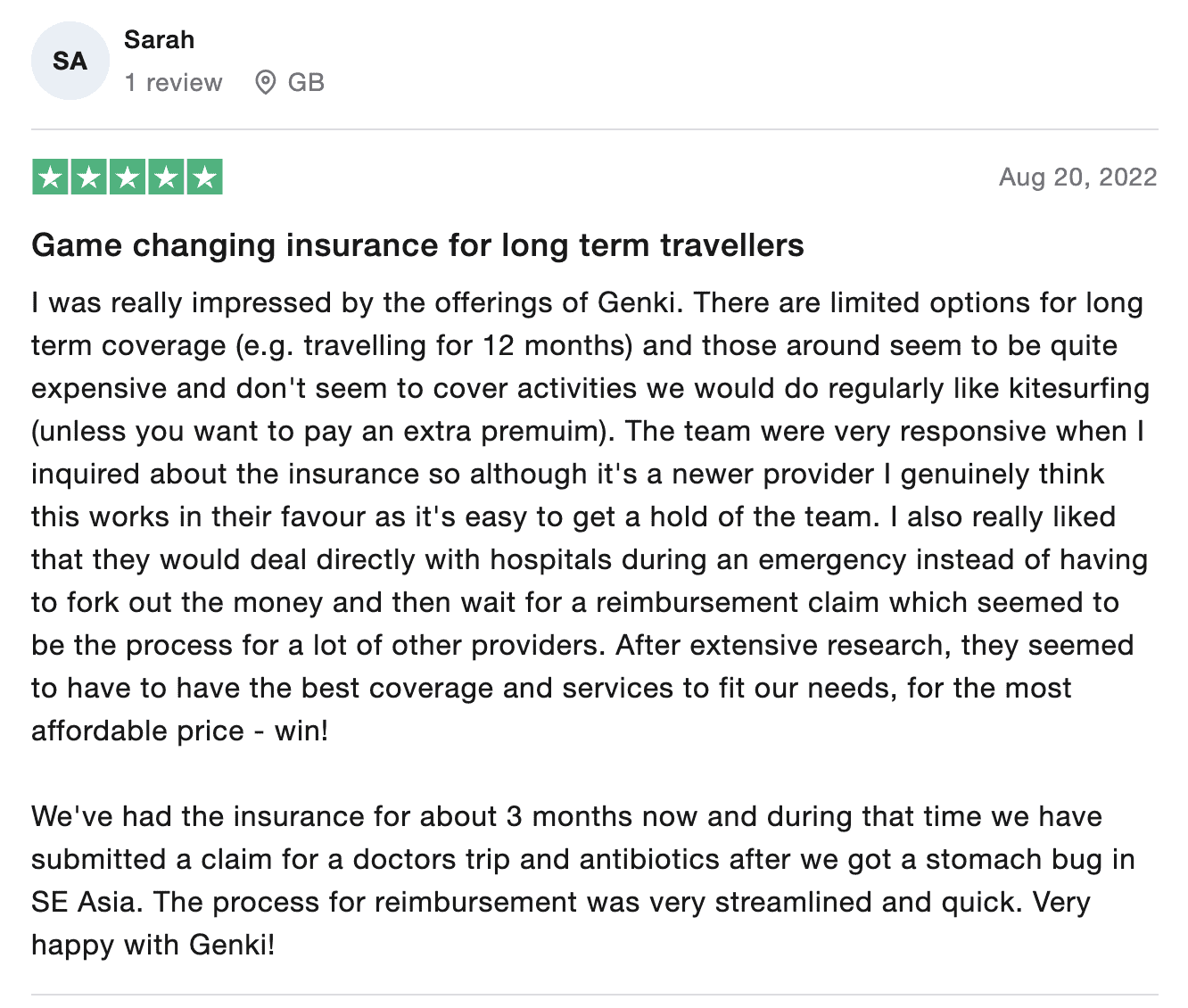

Does Genki Actually Pay Claims?

Probably the biggest factor when choosing a travel insurance provider is…

Being confident that they will actually pay and not try to weasel their way out of it.

Personally (and amazingly) we have not needed to file a travel insurance claim since we became digital nomads. So I can’t speak from personal experience with Genki.

But after speaking with one of their reps, Genki seems to have a really solid claims process. They are also governed by Europen law, which is generally very consumer-focused. That’s a good start, right?

But what about some real claim stories…

Trustpilot is where I go to get solid reviews from real people and Genki has a Trustpilot score of 4.3 out of 5 from 154 reviews which is excellent. 83% of all their reviews on Trustpilot are excellent.

This is pretty good for any insurance company.

A good number of people have also left detailed positive reviews about how good the claims process was. This is an excellent indicator of what Genki is like when you have an issue.

Genki’s biggest insurance partner is DR-WALTER, who will actually hand the claim They have a good reputation for being reliable and paying relevant claims on time.

There are also a few negative reviews so you can see what people were unhappy with Genki on Trustpilot. Genki responded to each negative review they got and explained the situation in further detail.

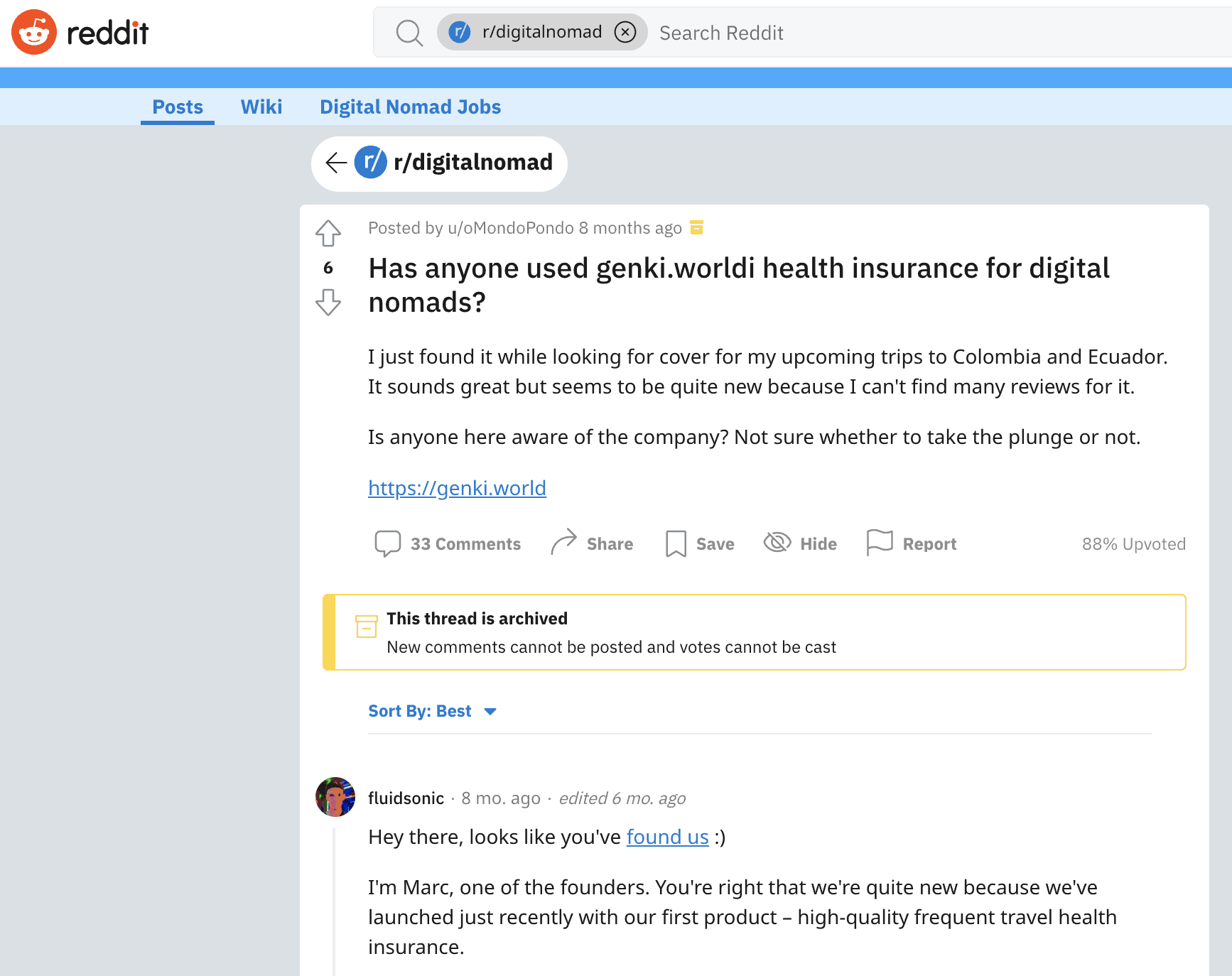

I have also seen Genki reps active on places like Reddit, which is always a good (and rare) sign of a great company.

So yes…

It looks like Genki does pay claims and payouts are provided in a timely manner. But it’s always good to double-check for yourself to make sure you feel comfortable.

Genki vs SafetyWing: Which One Is Best?

There are several digital nomad insurance companies that I could have compared Genki to.

But SafetyWing is by far their biggest competitor and offers subscription-based travel insurance as Genki does.

That’s why I chose them.

The truth is that it’s difficult to compare travel insurance companies head to head.

I have listed out some of the most essential aspects of Genki vs SafetyWing and put them in a table. Here’s the complete list:

| Benefits | Genki Insurance | SafetyWing Nomad Insurance |

| Starting Price |

€39.90 (About $41.30 USD) |

$45.08 USD |

| Deductible |

€50 |

$250 |

| Subscription Billing Date | Same Day Each Month | Every 28 Days |

| Emergency Medical Coverage | No Limit | $250,000 |

| Physical Therapy & Chiropractic Care | Up to $50 per day | Up to $50 per day |

| Emergency Dental | € 1,000 | $1,000 |

| Dangerous Activities | Very Few Exclusions | Many Exclusions |

| Emergency Mental Health | € 1,500 | None |

| Trip Interruption | None | Up to $5,000 |

| Travel Delay | None | Up to $100 a day after a 12-hour delay. Max 2-day period. |

| Lost Checked Luggage | None | $500 per item. Up to $6,000 lifetime limit. |

| Family Benefits | None | Children Under 10 Years are free. Max 1 Child per parent. |

| Home Country Coverage |

42 days within every 180 days. Exclusions apply. |

30 days within every 90 days. 15 days if you are from the US. Exclusions apply. |

| Average Claims Time | 2 to 4 Weeks | 4 to 7 Weeks |

| Continuous Coverage Period | 2 Years | 1 Year |

The only thing I need to point out about the price is that Genki charges you on the same day each month. SafetyWing charges you every 28 days.

That means Genki will end up charging you 12 times per year and SafetyWing will end up charging you 13 times per year. Keep that in mind when considering the long-term costs.

The Bottom Line On Genki vs SafetyWing

Genki is generally cheaper than SafetyWing and offers better medical coverage. They have a faster claims time and provide better coverage in your home country. You’ll also get continuous coverage for 2 years and very low deductibles (if any)

SafetyWing covers more than Genki. SafetWing offers a (very) low level of coverage for personal property, trip delays and lost baggage which Genki doesn’t. SafetyWing offers family benefits and may be slightly cheaper depending on your age. SafetyWing’s deductibles are MUCH higher but only have to be paid once. Genki’s deductibles are paid on every claim, every time.

But whether SafetyWing or Genki is better for you will come down to-

- Your age

- Benefits you find important

These are the two biggest factors. In terms of prices, they are actually pretty similar!

Want to learn more about SafetyWing? Make sure that you check out our complete SafetyWing review for a comprehensive breakdown of what’s included.

Is Genki Worth It?

Like all travel insurance – it depends on what you need.

Genki is cheaper than most competitors. How do they keep the price so low?

By focusing almost solely on emergency medical expenses.

But what you get with Genki vs the cost you is what makes Genki an excellent provider. Compared to competitors like SafetyWing, you get high coverage limits and much lower deductibles.

The claims period is also significantly shorter than most travel insurance providers, which is a big plus.

If you are primarily concerned about your medical insurance, you’ll find that Genki is one of the best providers available in terms of value for money.

Signup for Genki Insurance here.

How To Sign Up For Genki Insurance

Ready to signup for Genki Insurance?

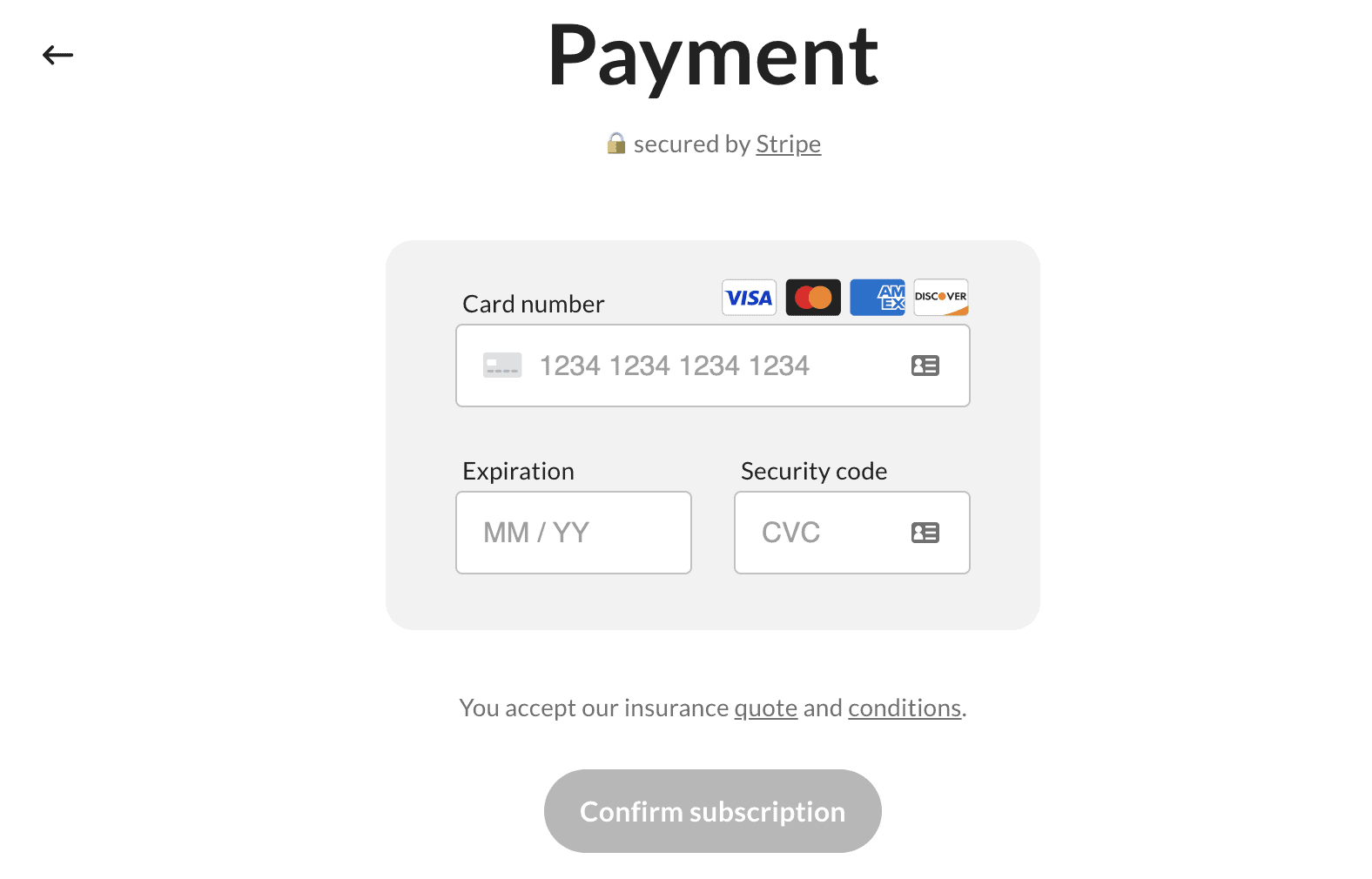

Genki has simplified the signup process, which means you get your coverage in minutes. Here’s how it works:

Head over to Genki.world.

Select the age range that applies to you and click Customize Your Plan.

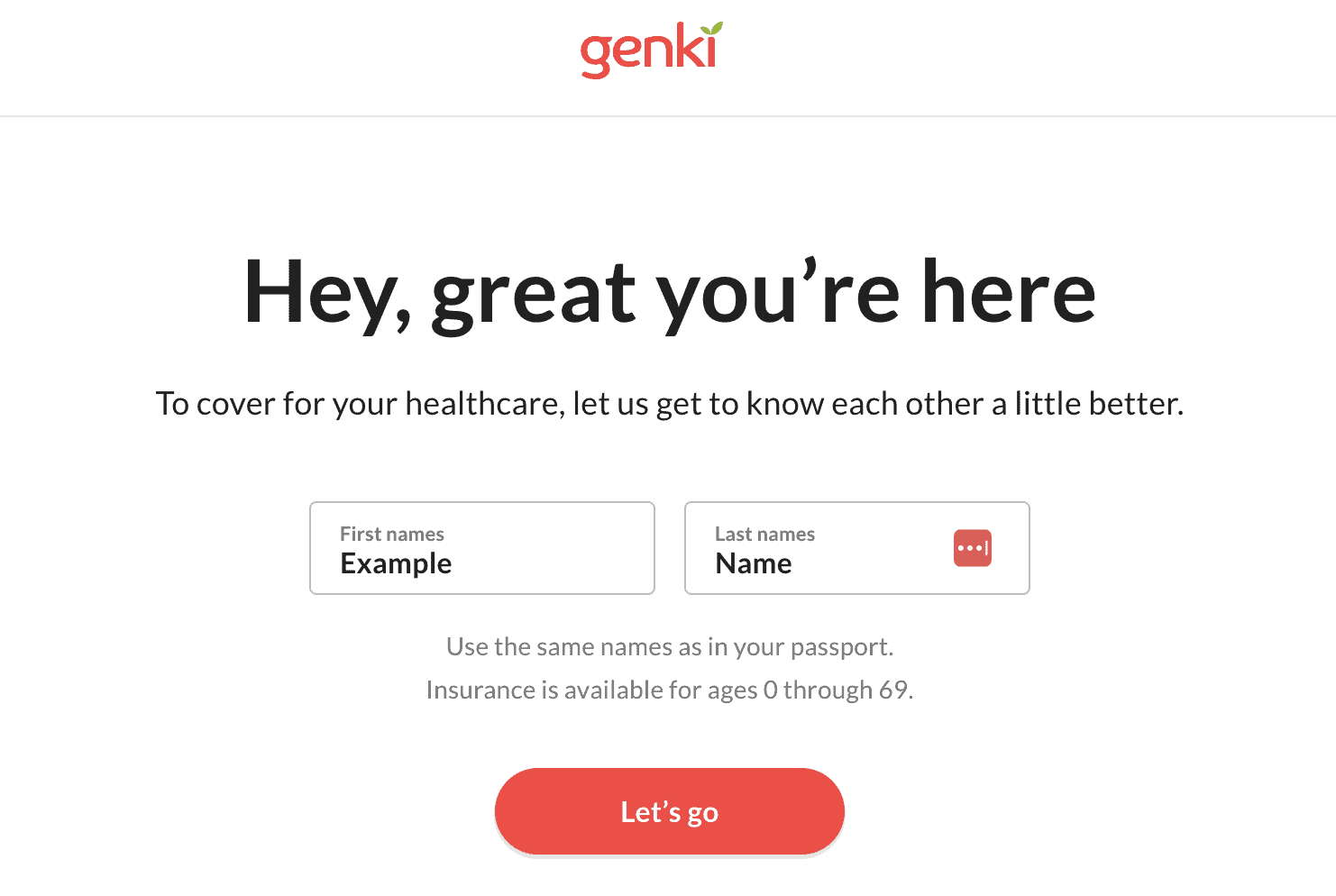

Add your first and last name, then click Let’s go.

Now select your home country.

Choose when you want your coverage to start. You can select a date in the future.

If you choose to start “Today”, the coverage will begin at Midnight in Germany’s local time zone.

Add in your email address and date of birth. Click Check price now – You should now see your general quote.

Lastly, you can customize your plan a bit.

Choose whether you want your insurance to cover the US and Canada and whether you want the deductible.

Click on the pink links to make the changes.

Now just add your credit or debit card details and click Confirm subscription.

You’ll get an email confirming your purchase immediately. The insurance certificate will be ready to download in about 1 business day. They’ll send you an email when it’s available for download.

That’s it!

Click here to get started with Genki insurance.

How Do You Cancel Genki Insurance?

You can cancel your insurance plan with Genki at any time.

You’ll remain insured until the end of your current billing cycle. You just need to go to their website and log in to your account to cancel. You can always start a chat with the Genki support team if you have any issues.

It’s also worth noting that you also have the right to withdraw from the insurance policy for a full refund within the first 14 days.

Just contact the support team to get that sorted!

Wrapping It Up

There you have it.

A complete Genki Insurance review.

Although Genki is relatively new to the digital nomad insurance world, I think they will make a big splash. They have put together a solid insurance plan offering great medical benefits and good value for money.

This, coupled with their easy-to-signup and transparent processes makes them very competitive.

As Genki Insurance grows, I think you can expect to see more customizable offerings. They have already told me they are working on family coverage, expanding the age range and adding things like trip delays and lost baggage.

Ready to get started with Genki?

If you have any questions feel free to leave them in the comments or you can contact the Genki Insurance team.

Want to see more options for digital nomad insurance?

Check out our complete guide on the best travel insurance for digital nomads.

Frequently Asked Questions

Is Genki Insurance legit?

Genki insurance is a legit company registered in Germany. They are backed by Allianz Partners and all of their claims are handled by DR-WALTER. Genki provides excellent value for money on comprehensive travel medical insurance.

Is Genki better than SafetyWing?

Whether Genki is better than SafetyWing comes down to each individual. Genki and SafetyWing cost about the same depending on your age. Genki generally has better medical coverage, while SafetyWing covers a little bit more. Genki also has a better reputation for paying claims than SafetyWing and costs less for most people.

Will Genki cover a scooter crash?

Genki does cover scooter crashes and accidents. If you are planning to ride a scooter while overseas and traveling, Genki has you covered.

Hey man,

Love the website and your articles have been very useful, much thanks for that!

What I wanted to know, have you ever looked into Dr Walter for travel health insurance? (They handle Genki’s claims as you know and their basic medical package is the same price as Genki’s one – for a person with my details – you know what that means). I don’t see Dr Walter compared on any review article of website for digital nomads health insurances but their product looks excellent.

Much thanks and all the best on your journey to you both!

Thanks for the comment! We haven’t looked into specifically what insurance plans they offer. But they do have a good reputation.